Is trouble brewing for heavily indebted households as interest rates rise?

The Reserve Bank of Australia has lifted the cash rate twice in the past two months, rapidly taking it to 0.85% from a low of 0.10%. This has ended the era of super cheap home loans as banks pass on the RBA’s interest rate rises to borrowers in full.

And with the central bank likely to raise the cash rate again to curb inflation, mortgage holders are in for more interest rate pain.

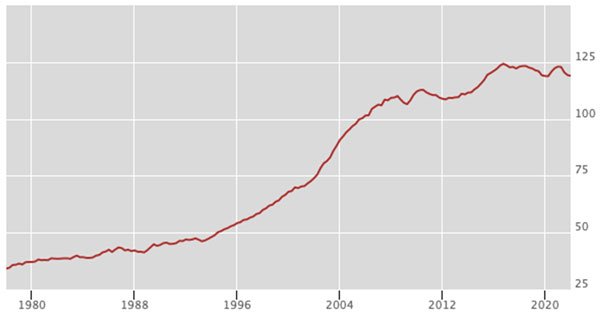

Figure 1: Australian household debt as a percentage of GDP

Source: Bank of International Settlements

The debt connection

Australia has one of the highest levels of overall household debt in the world, with recent data from the Bank of International Settlements showing it is equivalent to 119% of GDP.

AMP Chief Economist Shane Oliver explains what this means in absolute terms. “In 1990, there was on average $69 of household debt for every $100 of average household income after tax. Today, it’s $187 of debt for every $100 of after-tax income.”

With most of that debt linked to mortgages, households are sensitive to increases in home loan interest rates.

According to comparison site Finder, June’s 0.5 percentage point hike alone would add $159 to monthly repayments on a $600,000 mortgage with a 3% home loan rate. That’s nearly $2,000 a year.

“We have a big potential problem courtesy of the way we have run our housing system for not just the last decade but for the last at least three decades,” says Chris Martin, a Senior Research Fellow at the University of New South Wales’ City Futures Research Centre, referring to policies that have encouraged Australians to get into debt.

In what he calls a “double whammy for indebted households”, Tim Lawless at CoreLogic notes how the added cost of loans comes as prices of non-discretionary goods rise more than twice those of discretionary items.

“Higher costs for food, fuel and finance are likely to see household savings continue to taper as families funnel more of their income towards servicing their mortgage and funding essential costs of living,” says Lawless.

Not a major problem

Oliver acknowledges that the combination of rising rates and high household debt is an issue. But he believes it’s not as bad as it looks.

“First, the rise in debt partly reflected a rational adjustment to lower rates and greater credit availability since the 1980s,” he says. “Second, household debt has been trending up since credit was invented.”

In other words, it was natural for household debt to have soared to where it is now.

Australians have also created more wealth than they have accumulated debt, thanks to a surge in home values and financial holdings, particularly post-pandemic. This gives them a buffer against the rising interest rates.

“So while average household debt for each Australian has risen from $11,779 in 1990 to $107,318 now, average wealth per person has surged from $87,489 to $655,894.”

Oliver adds that most Australians are still servicing their loans diligently, as banks’ low levels of non-performing loans suggest. It’s also higher-income households that hold more debt, which means that they have better capacity to pay back their loans.

“Finally, lending standards did not deteriorate to the same degree in Australia as they did in the US prior to the global financial crisis,” says Oliver.

“The key is that the RBA only needs to raise interest rates far enough to cool demand to take pressure off inflation and keep inflation expectations down.”