Open banking is here, having kicked off its first stage on 1 July 2019. But what does it mean for you as a business banking customer? Have you thought about how you can gain from it?

Open banking makes it easier for individuals and businesses to view their banking data, such as their credit cards’ historical transaction data, and take advantage of it. It is the first application of the government’s Consumer Data Right, which aims to give Australians greater choice and control over how their data is used and disclosed.

From 1 July 2019, banks only have to publish generic product information to help you compare banking products. But by 1 February 2020, you will have access to information on your:

- mortgages

- credit and debit cards

- deposit and transaction accounts.

Data on all other products proposed under open banking will be available from 1 July 2020. But keep in mind that only the four major banks – Commonwealth Bank, ANZ, Westpac and NAB – will need to make customer data available starting July 2020. Other banks get a one-year lag.

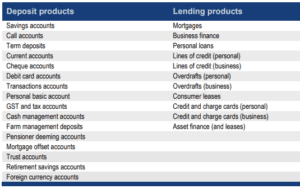

Products to be included in open banking

What’s in it for you?

At present, it’s hard to get your business’s comprehensive banking data, let alone share it with other banks or financial services providers. This makes it hard to shop around for better deals and switch providers.

But with open banking, you can ask your bank to transfer your business’s data to your authorised accredited third party via a secure dedicated platform. An accredited third party can be a financial services provider, fintech firm, product comparison site or another bank.

Your authorised third party can aggregate your data to help you find a better deal or develop products that suit your business’s financial position. For example, using information on your firm’s income, expenses and financial commitments, an accredited financial services provider can tailor a business loan and an interest rate based on your ability to meet repayments.

You are in control of your banking data

You have to give your consent before a third party can access your business’s data

Open banking will usher in greater competition in financial services. Banks, for example, will want to retain their customers and offer them competitive deals. Smaller lenders will be able to compete with large banks through having more data to assess borrowers’ serviceability and being able to offer loans to more customers.

What risks should you be aware of?

While open banking lets you harness the value of your business’s data, it can pose a risk to the privacy and security of your information. That’s because data will be moving from one firm to another.

But don’t fret. The regulators and agencies responsible for open banking are addressing potential data security issues. The Australian Information Commissioner, for example, has to ensure companies participating in open banking follow rigorous standards for accessing and keeping information.

It also pays to know exactly what you can do under open banking. For example, when asking your bank to share your business data, you can specify what information you want shared, who can access it, and for how long. And in your arrangement with a data recipient, be clear about what your data is for.

Your customers will have the same ability to use their data, so assess risks and opportunities for your business. For example, if you’re a mortgage broker, instead of seeking your help, a potential customer could go straight to a lender, to ask them to assess their data for their borrowing capacity. But you could take this as an opportunity to highlight how you could help borrowers in other areas – for example, you could advise them on the various types of home loans and what’s suitable for them.

Finally, be selective about the providers you work with. Assess their security protocols for handling your information. There’s power in your data, so only share it with firms you trust.